haven't done my taxes

The IRSs free file program is one option and it is currently open through November 17. If you qualify your rebate is equal to the property tax credit you were able to claim on your 2021 IL-1040 form up to 300.

Here S What Happens If You Don T Pay Your Taxes

2 days agoThe IRS wants you to get your stimulus check and child tax credit cash if you havent claimed it heres what to look for Last Updated.

. If youre overwhelmed with your taxes they might be able to support you with any tax issues as you file. For each month that you do not file. Answer 1 of 2.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing. I havent done my taxes 0 3 125 Reply. But if you filed your tax return 60 days after the due date or the.

If you are one of the many. While a tax extension typically gives you until Oct. The failure-to-pay fee is equal to 05 of the tax owed after the due date for each month or part of a month that the tax remains unpaid.

So lets say you owe. Level 15 July 14 2022 214 PM. It would be very difficult to have a tax owed if you are a w-2 employee.

Regardless of your reason for not filing you should file your federal tax return as soon as possible. Property owners can still receive a rebate if they file an IL. 13 hours agoThere are a few options for returning items.

Self-employed workers have until June 15 2018 to file their tax return. 15 to file a return the date falls on a Saturday in 2022 so taxes are due by the following Monday Oct. This amount can total up to 25 of.

The penalty charge will not exceed 25 of your total taxes owed. Using the IRS Wheres My Refund tool. If youre required to file a tax return and you dont file you will have committed a crime.

The good news is that the failure-to. When you owe money and are late with a tax return you get penalized to the tune of 5 per month or partial month your return is late up to a total of 25. If you file but dont pay youll have 05 of your unpaid taxes added to your bill each month which can build up to 25 of your taxes owed.

Subscribe to RSS Feed. 17 this year to get your paperwork. Are you a w-2 employee.

15 2022 at 1214 pm. A site the government created for child. If you havent filed a tax return for several years it could lead to some severe consequences and financial losses.

The criminal penalties include up to one year in prison for each year you failed to file and fines up to. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. You could lose your chance to claim your tax.

If the IRS has not contacted you then you either moved and they dont know. Premium federal filing is 100 free with no upgrades for premium taxes. That extension will not change the due date for any money you need to pay the IRS.

Contact a tax professional. In other words a tax extension will give you until Oct. Ad Federal Tax Filing is Always Free for Everyone.

Take advantage of all the available tools found on. Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Viewing your IRS account. This penalty is usually 5 of the unpaid taxes. The CRA will let you know if you owe any money in penalties.

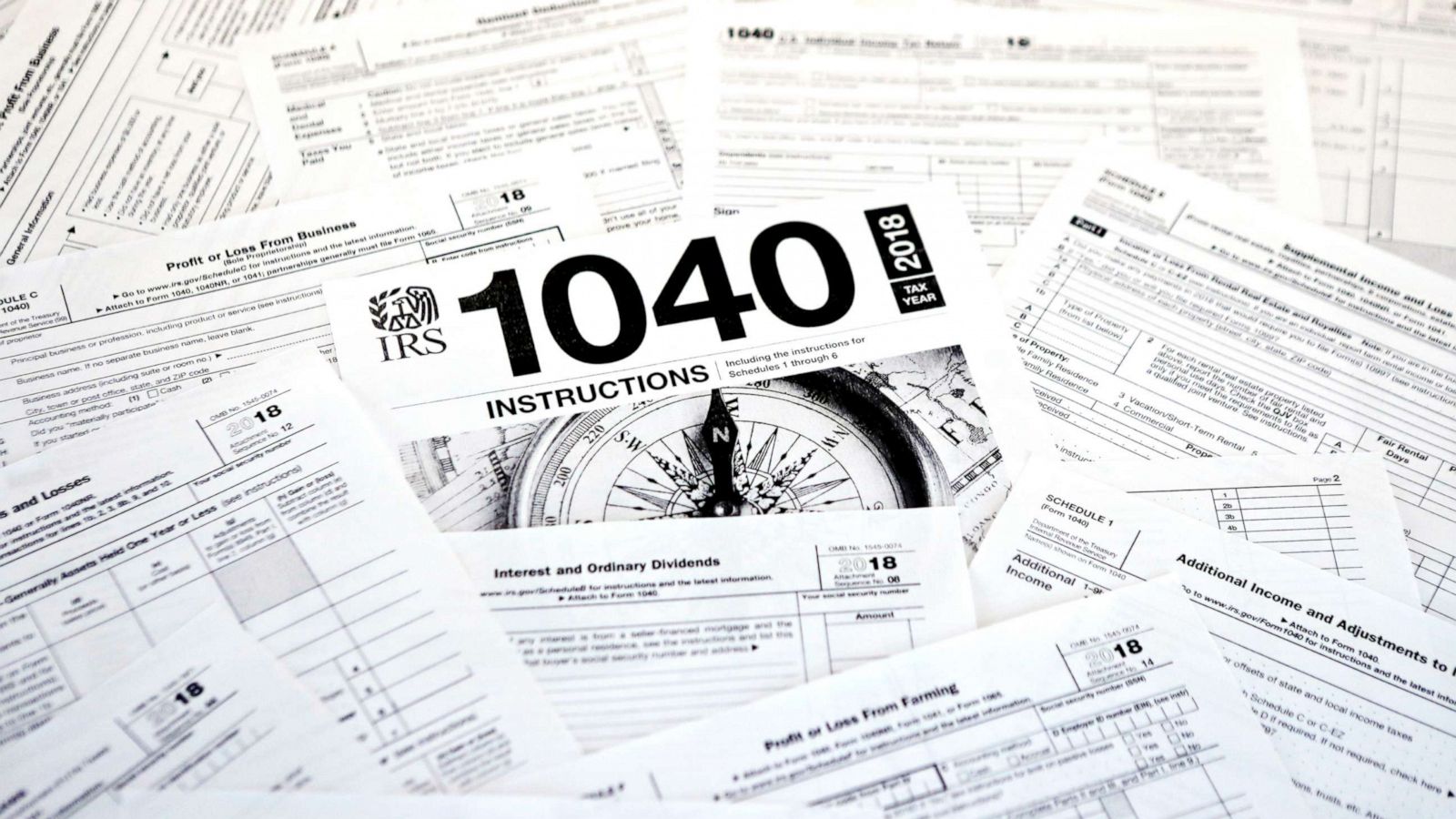

Whether you are filing as an individual or as a business you likely will see a few changes this year when you file your 2018 federal income tax return.

Taxes 2022 What To Do If You Haven T Filed Your Return Yet Youtube

Edwins Leadership Restaurant Institute Empowers Formerly Incarcerated Adults

20 Things To Know About U S Taxes For Expats H R Block

Why You Should File A Tax Return Even If You Don T Need To

If You Haven T Filed Your Tax Returns Yet Here Are Your Options Abc News

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

As Home Sale Prices Surge A Tax Bill May Follow The New York Times

If You Filed For A Tax Extension You Have Until October 17 To File Here S Why You Shouldn T Wait Nextadvisor With Time

No You Haven T Lost Your Overwatch Skins Progress And Other Items In Overwatch 2

Topic No 153 What To Do If You Haven T Filed Your Tax Return Internal Revenue Service

You Can Try But I Strongly Don T Advise You To Doritosdaretobeburned Russellwestbrook Russellwestbrook Russellwestbrookedit Russellwestbrook Russellwestbrook Understandlife Fypシ Fyp Tb4l Toxic Toxicity

How To Contact The Irs If You Haven T Received Your Refund

Homeowner Tax Rebate Credit Htrc

𝐅𝐎𝐑𝐄𝐈𝐆𝐍 On Instagram Haven T Done My Taxes I M Too Turnt Up Fashion Instagram Tax

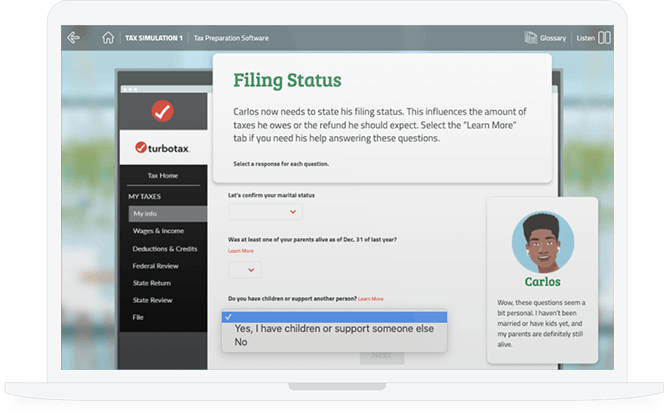

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

I Haven T Done My Taxes I M Too Turnt Up T Shirt For Sale By Ravishdesigns Redbubble I Havent Done My Taxes Im Too Turnt Up T Shirts Life Is Good T Shirts

The Extended Tax Deadline Is Oct 17 Here S What Filers Need To Know